Delhi Property Tax Waiver Scheme 2025: Major Relief for Property Owners

In a major move to ease financial pressure on property owners and improve tax compliance, the Municipal Corporation of Delhi (MCD) has introduced the Property Tax Waiver Scheme 2025. This initiative brings full or partial waivers on house tax for lakhs of residents across the capital, particularly those owning smaller residential and commercial properties.

Let’s dive into the details of the scheme, eligibility, benefits, and how you can apply.

Why This Scheme Matters

Property tax in Delhi has long been a contentious issue, with many residents delaying or defaulting on payments due to outdated assessments, unclear records, or financial strain. The 2025 waiver scheme aims to:

- Simplify compliance and encourage prompt payment

- Provide relief for low- and middle-income property owners

- Increase tax revenue through voluntary compliance

- Regularize tax records with updated data

Key Benefits Under the Scheme

Here’s a breakdown of what’s being offered:

100% Waiver for Properties Up to 100 sq. yards

- Applies to residential properties and small shops

- No house tax payable for FY 2024–25

- Prior dues completely waived upon payment of current tax (if applicable)

50% Waiver for Properties Between 100–500 sq. yards

- Substantial discount on total tax liability

- Applies to most middle-class households in DDA colonies and cooperative societies

25% Rebate for Housing Societies

- Around 1,300 group housing societies previously excluded from rebates will now benefit

- Aimed at regularizing bulk property data

Commercial Property Relief

- Properties in rehabilitation colonies and notified commercial zones will enjoy similar relief

- A welcome move for small traders and shopkeepers

Timeframe & Eligibility

Waiver Period: Applicable for dues till March 31, 2024, and tax payments due in FY 2024–25

Eligibility Conditions:

- Owners must pay their current FY 2024–25 tax in full

- Property must be recorded with MCD with correct category and usage

- No pending litigation on property ownership

How to Avail the Waiver Scheme

Here’s how you can benefit:

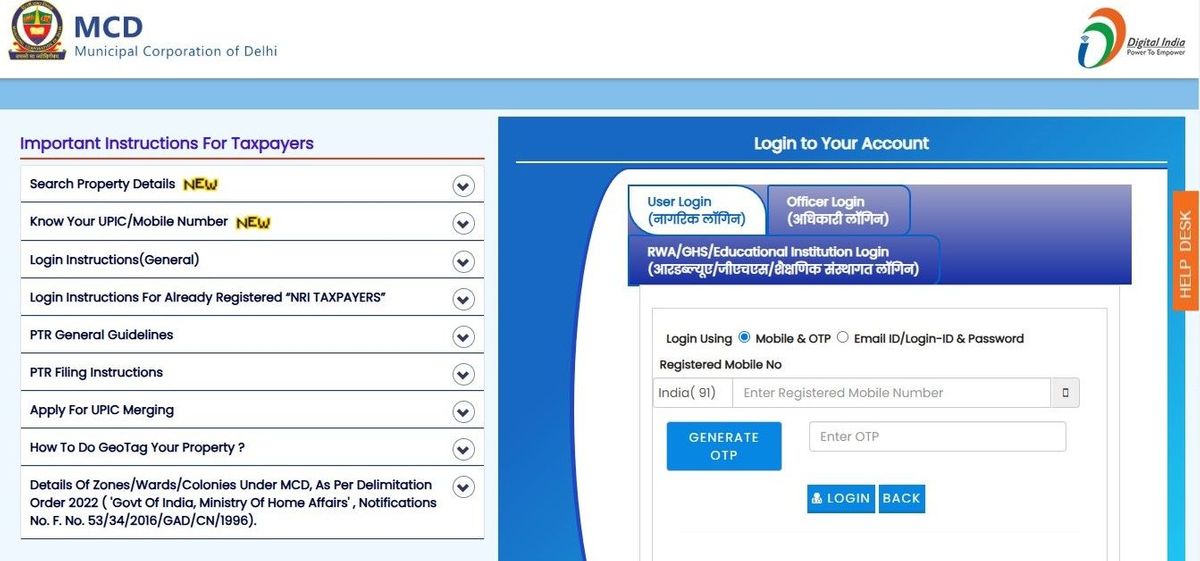

- Visit the MCD Portal: https://mcdonline.nic.in

- Check Your Property Details: Use the Property ID to confirm size, type, and tax status

- Make Payment for FY 2024–25: This activates the waiver for previous dues

- Download Updated Receipt: For records and legal proof of exemption

Important Notes

This is a one-time amnesty scheme; no extensions guaranteed after the deadline

Failure to pay FY 2024–25 tax means old dues will remain enforceable

Updated records are crucial: ensure your property measurements and category are correctly reflected on the portal

Government’s Perspective

MCD officials have emphasized this scheme as a way to bring transparency and ease to tax administration while also encouraging voluntary compliance. This approach aligns with the Delhi government’s broader efforts to digitize services and make governance more citizen-friendly.

The Delhi Property Tax Waiver Scheme 2025 is a golden opportunity for property owners—especially those with unresolved past dues or outdated records—to clear their liabilities at minimum cost. Whether you’re a homeowner, shopkeeper, or part of a housing society, don’t miss this limited window to regularize your property tax status.